Trader's CPA

Trade smart. File smarter. Let the IRS owe you this year.

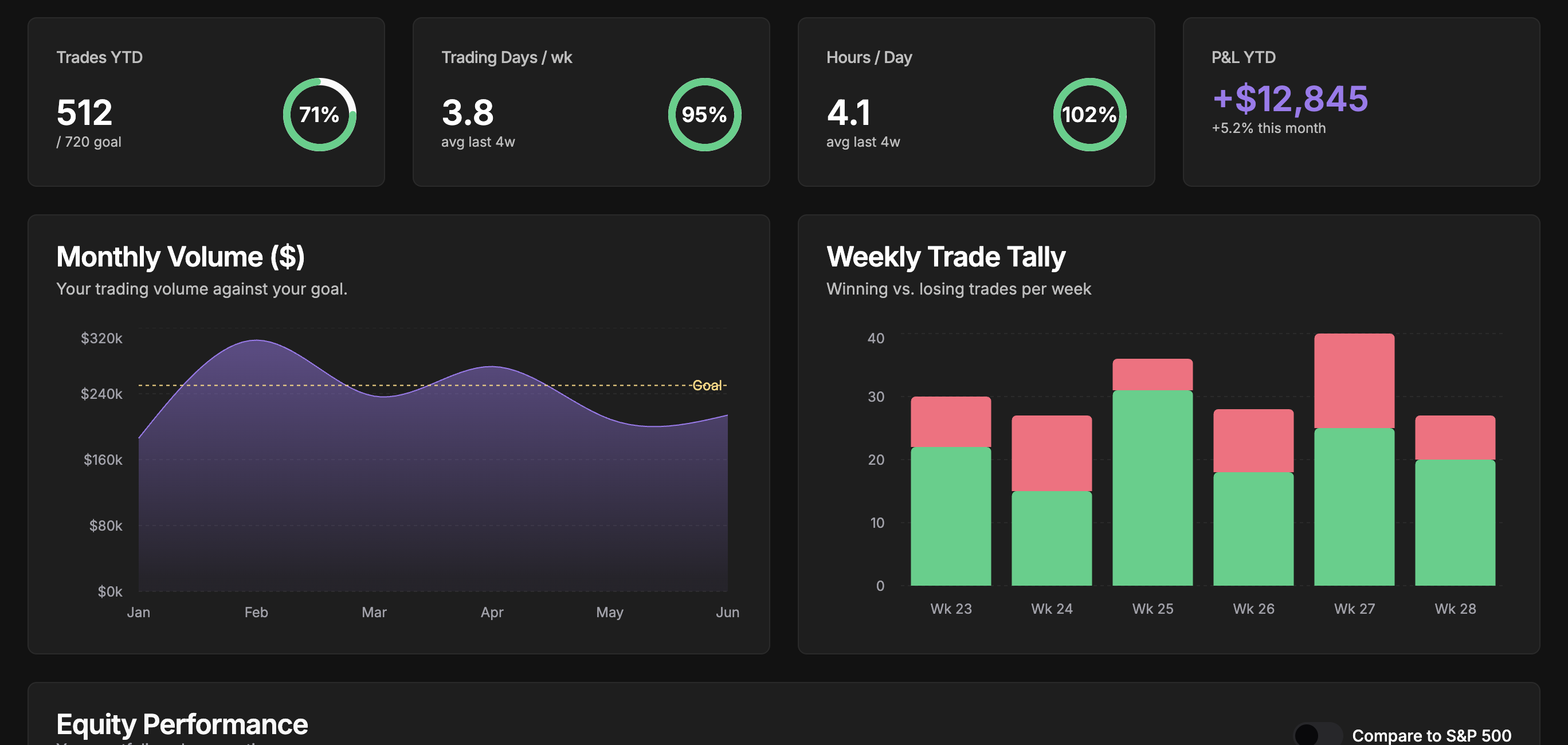

Do More With Unified Brokerage Analytics

Primary outcomes that matter for active traders.

Aggregate realized P&L across brokerages to forecast quarterly estimated tax payments in minutes.

Consolidate trades from multiple accounts to detect and avoid cross-brokerage wash sale conflicts before they happen.

Track activity, logs, and documentation required to qualify for and maintain TTS with confidence.

The Audit-Proof Path to TTS

We provide the evidence the IRS looks for: substantial, continuous, and regular trading activity. Trader Tally gathers and organizes everything you need to build an undeniable case.

- Automated time-logging for trading activities

- Detailed trade history and volume tracking

- Journaling tools to document your strategy and intent

- Expense tracking for all your business deductions

- Export-ready reports for your CPA

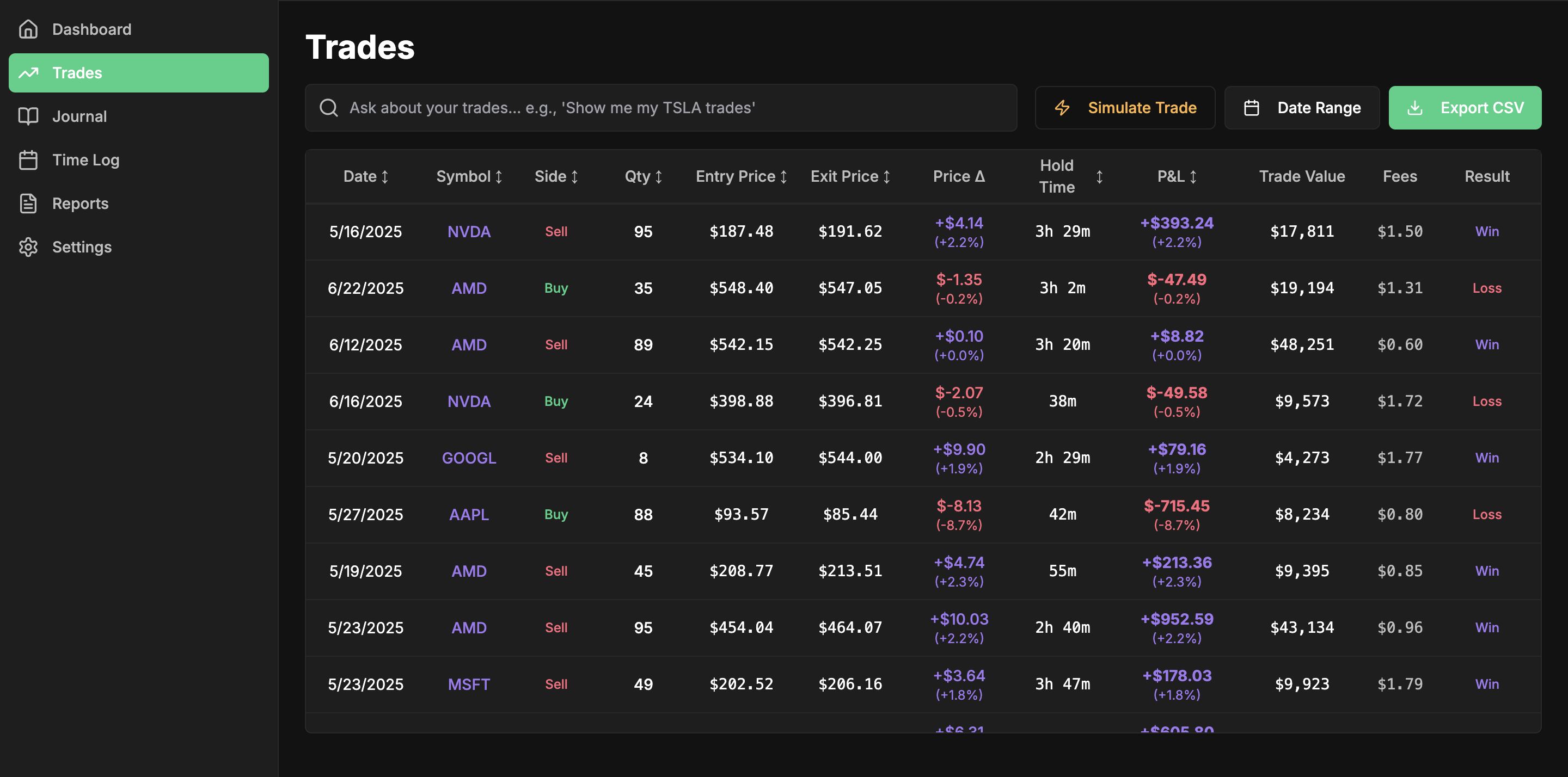

See It In Action

From dashboard to deductions, see how we make tax-loss harvesting intuitive.

AI-Powered Trade Analysis

Maximize your profit and minimize losses by truly knowing your trades. Our AI-powered analysis helps you identify patterns, optimize strategies, and make data-driven decisions that turn every trade into a learning opportunity for greater profitability.

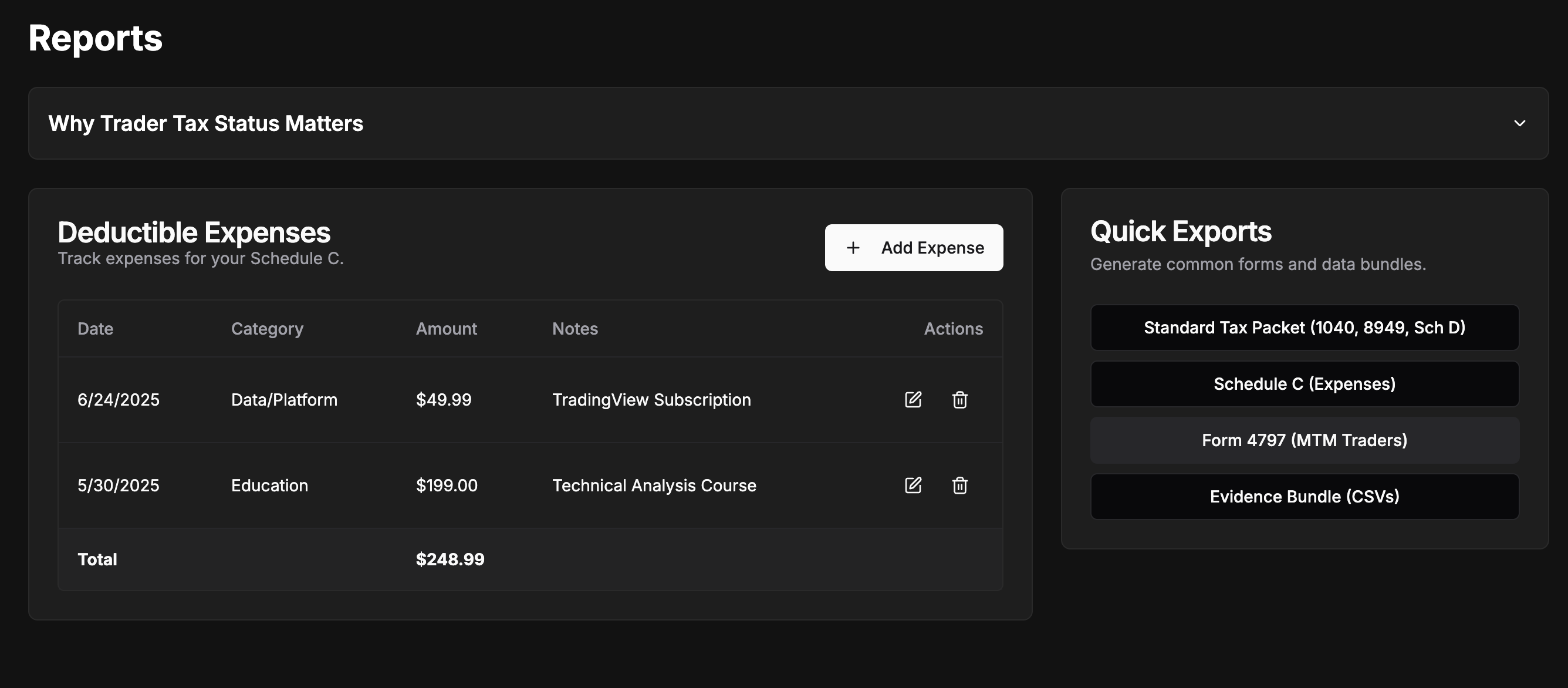

Track Every Deduction

From platform fees to home office costs, log every expense in CPA-ready categories.Sign up to track real deductions

| Date | Category | Notes | Amount |

|---|---|---|---|

| 2025-07-01 | Data/Platform | TradingView Pro+ | $49.99 |

| 2025-06-25 | Hardware | New Ultrawide Monitor | $599.00 |

| 2025-06-15 | Education | Options Trading Course | $299.00 |

| 2025-06-01 | Home Office | High-Speed Internet | $75.50 |

Traders Qualified for TTS with TraderTally

“TraderTally was the missing piece. It organized my records perfectly, and my CPA was thrilled. I finally qualified for TTS and saved thousands.”

Sarah J. – Futures Trader

“I used to spend weeks compiling data for my accountant. With TraderTally, it took less than an hour. The reporting is a game-changer.”

Mike R. – Equities Day Trader

“The automated time-logging and journaling features helped me build a solid case for being a full-time trader. Highly recommended.”

Chen L. – Options Trader

Simple, Transparent Pricing

One price. All features. No hidden fees. Start your 30-day free trial today.

- Unlimited Trades & Broker Connections

- Wash Sale Detection (IRS Section 1091)

- Quarterly Tax Estimates

- Tax Loss Harvesting Opportunities

- CPA-Ready Tax Reports

- Plaid Integration for Major Brokers

- Real-time P&L Tracking

- Priority Support